The Fair Labor Standards Act (FLSA), commonly referred to as the Wage and Hour Act, was passed in 1938 and since then has been amended many times. The major provisions of the FLSA are concerned with minimum wage rates and overtime payments, child labor, and equal rights. The US Department of Labor, Wage & Hour Division, oversees federal labor laws. Additionally, State DOLs administer state labor laws. Failure to comply with Wage & Hour laws may result in the employer paying the employee back wages, damages, penalties, attorney fees and court costs, plus the prospect of civil and criminal penalties from federal and/or state governments. Therefore, Wage & Hour compliance is of the utmost importance.

Why Should You Attend / Learning Objectives: This webinar will lay the groundwork for determining whether your employees are properly classified as Exempt or Non-exempt and ensuring that wage and hour laws are being followed properly.

Areas Covered in the Session:

- What is the Fair Labor Standards Act?

- Tests used to determine if an employee is exempt from FLSA

- Importance of determining the primary duty of a job

- The six FLSA exemptions

- Exempt vs. Non-Exempt status

- Salary Level and Salary Basis tests

- Determining when to pay overtime

- Calculating overtime pay

- Minimum wage provisions under FLSA

- Anticipated changes to the salary level test

- Equal pay provisions under FLSA

- Child labor regulations

- Recordkeeping requirements

- Repercussions of FLSA non-compliance

Certification:

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

Who Will Benefit:

- Human Resources Professionals

- Compensation Professionals

- Compliance professionals

- Managers & Supervisors

- Employees

Speaker

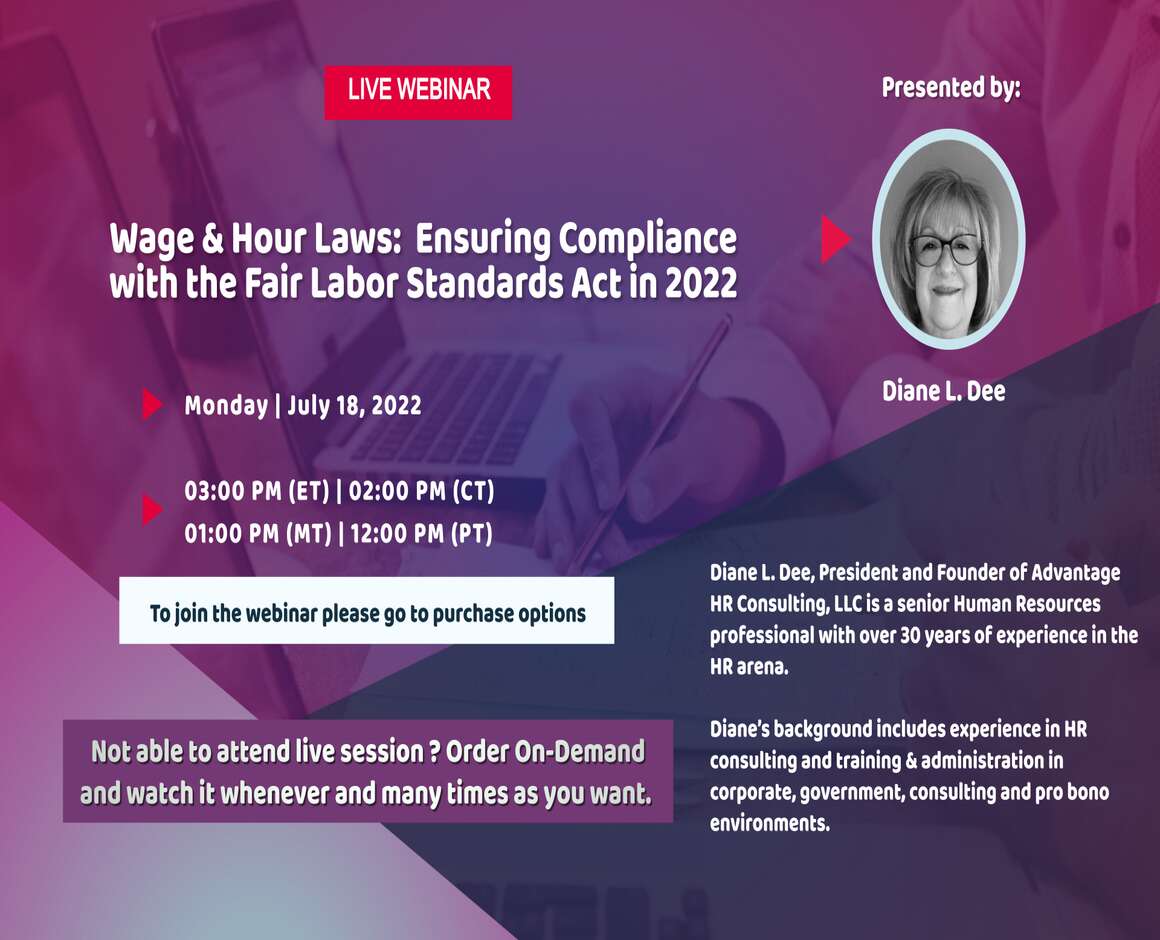

Diane L. Dee

Diane L. Dee

Diane L. Dee, President and Founder of Advantage HR Consulting, LLC is a senior Human Resources professional with over 30 years of experience in the HR arena.

Diane’s background includes experience in HR consulting and training & administration in corporate, government, consulting and pro bono environments.

Diane founded Advantage HR Consulting in early 2016. Under Diane’s leadership, Advantage HR Consulting provides comprehensive, cost-effective Human Resources solutions for small to mid-sized public and private firms in the greater Chicagoland area. Diane also develops and conducts webinars on a wide variety of HR compliance and administrative topics for various training firms across the country. Additionally, Diane is the author of multiple white papers and e-books addressing various HR compliance topics.

Diane holds a Master Certificate in Human Resources from Cornell University’s School of Industrial and Labor Relations and has attained SPHR and SHRM-SCP certification. Diane performs pro bono work through the Taproot Foundation assisting non-profit clients by integrating their Human Resources goals with their corporate strategies.

Certifications

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

Pedu Courses and Webinar or any Education published “Articles & Materials” strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Pedu doesn’t support any Fake – News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

FAQ's

How do I get enrolled for this webinar/course?

Sign up now on pedu.io. Visit pedu.io to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

Can I get somebody else enrolled for this course? If yes, how?

You can refer Pedu to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on pedu.io today!

How can I access the live webinar?

Go for the topic of your keen interest on pedu.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

Can I attend the webinar without an internet connection?

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording.

What is an “On Demand”?

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Will the transcript be a hard-copy or a soft-copy?

Pedu offer only soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

Can I ask question(s) to the speaker?

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

I missed the live webinar. What now?

Don’t worry, If you can’t join live webinar. Pedu has automatically send you On Demand on your registered mail id after conducting live webinar. So, you never miss out a single detail.

Isn’t it helpful?

Ask your question directly from our Customer Support Team.

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Pedu is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org. This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

This Program has been approved for 1.5 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™ and SPHRi™recertification through HR Certification Institute® (HRCI®).

Diane L. Dee

Diane L. Dee